Unique Info About How To Settle Irs Debt

Get free, competing quotes for tax relief programs.

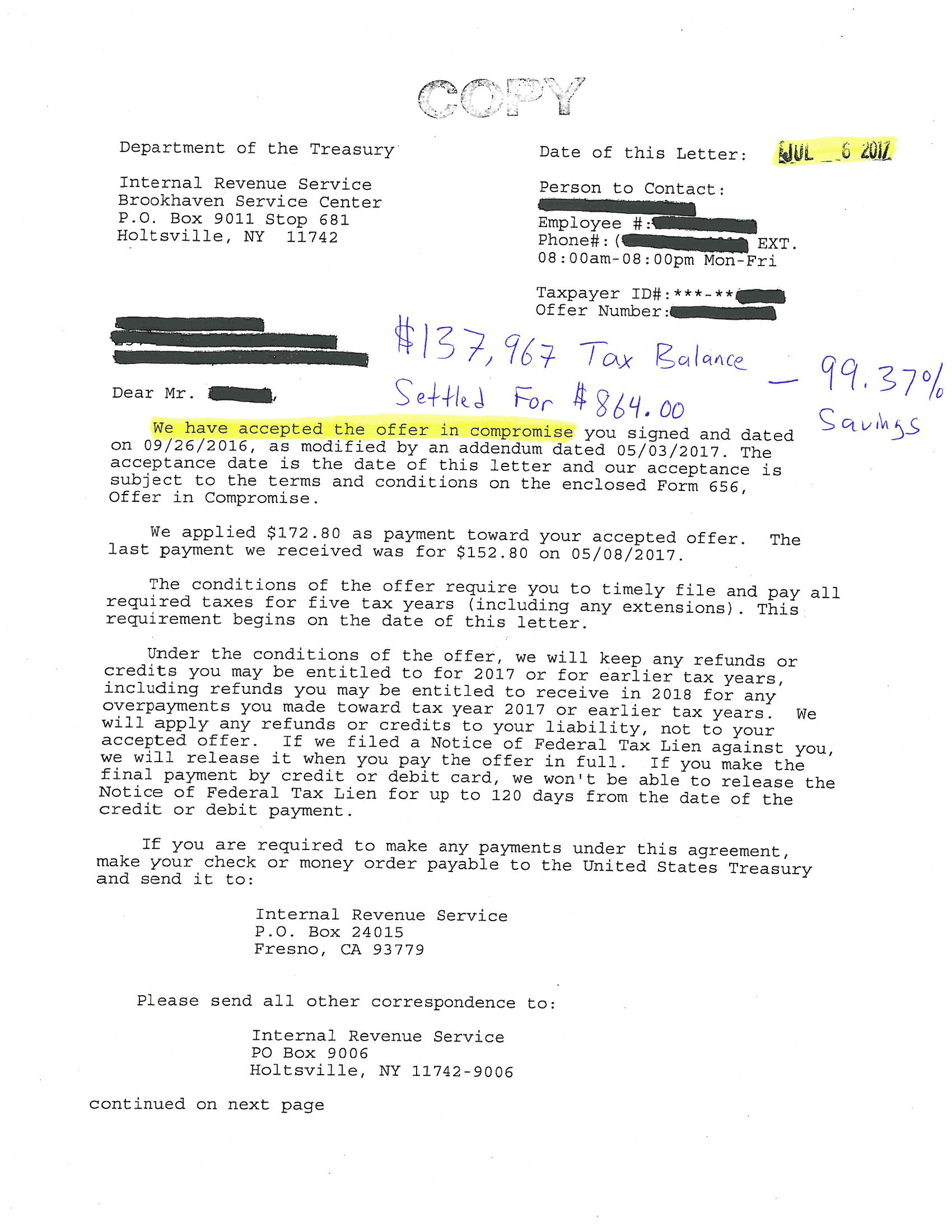

How to settle irs debt. Making an offer in compromise (oic) is one of a few options taxpayers have to work things out with the. Ad don't let the irs intimidate you. We have resolved over $1 billion dollars in tax debts for our clients.

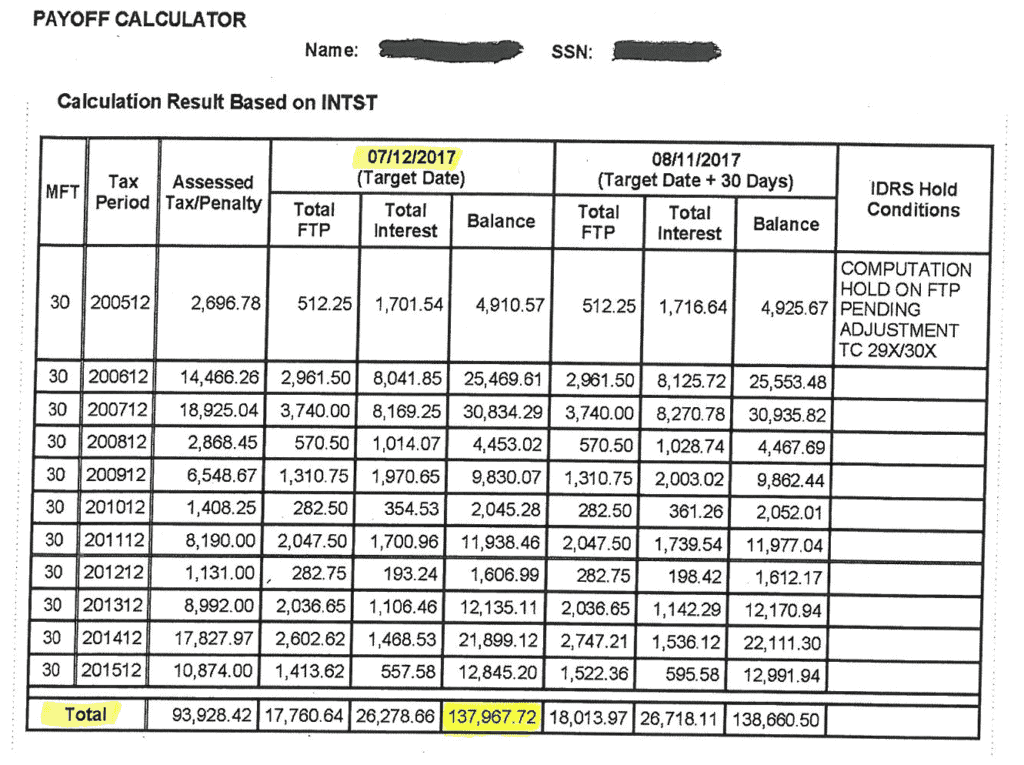

Individual taxpayers and business owners can use the irs's recently updated offer in compromise booklet pdf to learn how an offer in compromise works and decide if it could. Return your application and offer application fee. If you have an irs tax debt, the first step is figuring out a way to get your irs tax settlement done.

You must also provide a. An offer in compromise is one of the multiple payment options the irs offers to taxpayers. The first thing you should do is educate yourself about the irs’s debt collection process.

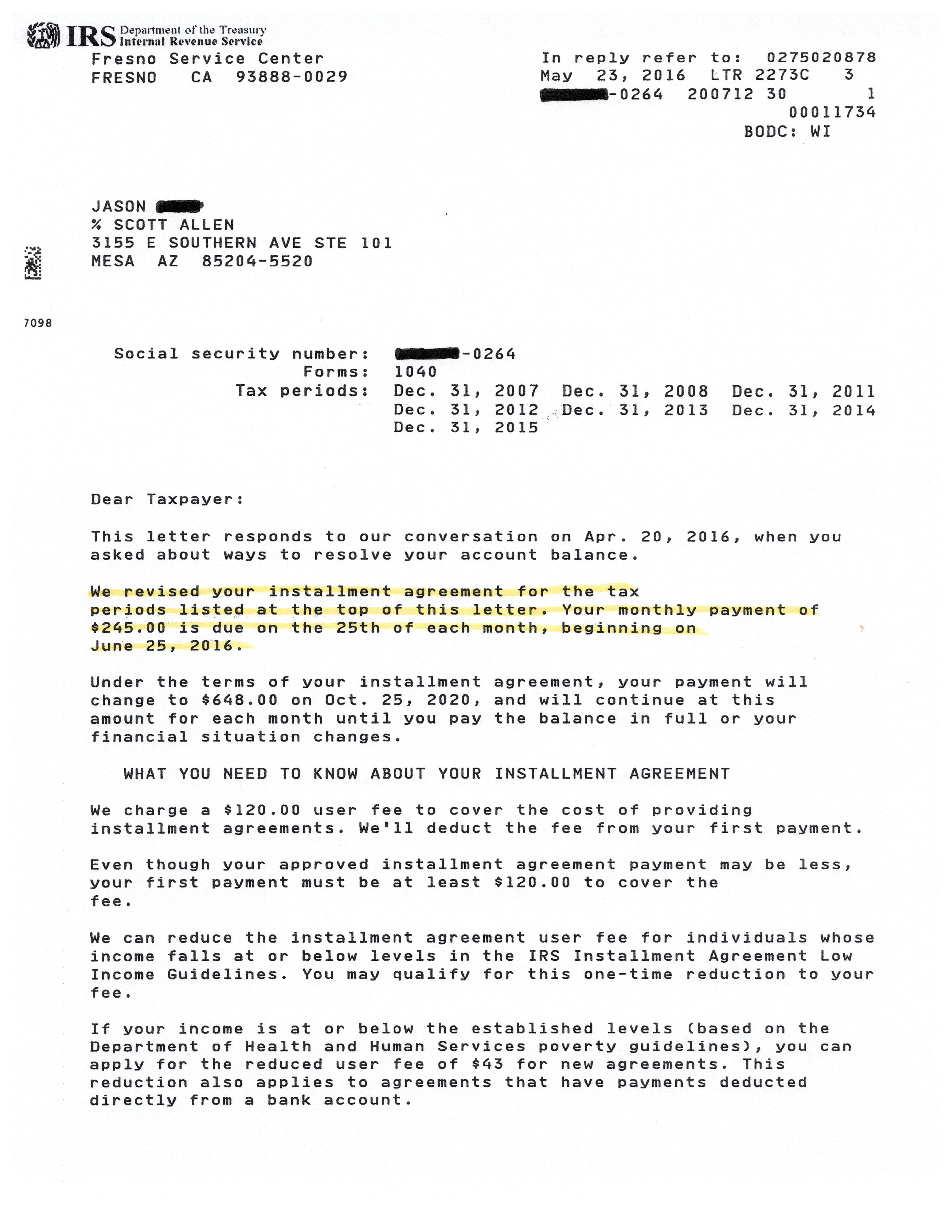

Offer in compromise partial payment installment. End your irs tax problems. You can resolve your tax debts on your own if owe the irs less than $10,000 with a payment plan that suits your budget.

The irs debt settlement options the irs offers a few different debt settlement options for unpaid taxes. You've likely seen and heard ads from companies claiming they can settle your debt with the irs for pennies on the dollar. they claim you need their services to strike a deal. Ad we can negotiate for up to 95% less.

Settlements can take up to a year however. While there are some options to settle your tax debt that don’t involve direct contact with the irs, it’s usually best to seek professional help, especially if you’re in truly dire. We have resolved over $1 billion dollars in tax debts for our clients.